owner draw vs retained earnings

A draw lowers the owners equity in the business. In 1983 Warren Buffet put out his first Owners Manual for Berkshire Hathaway shareholders.

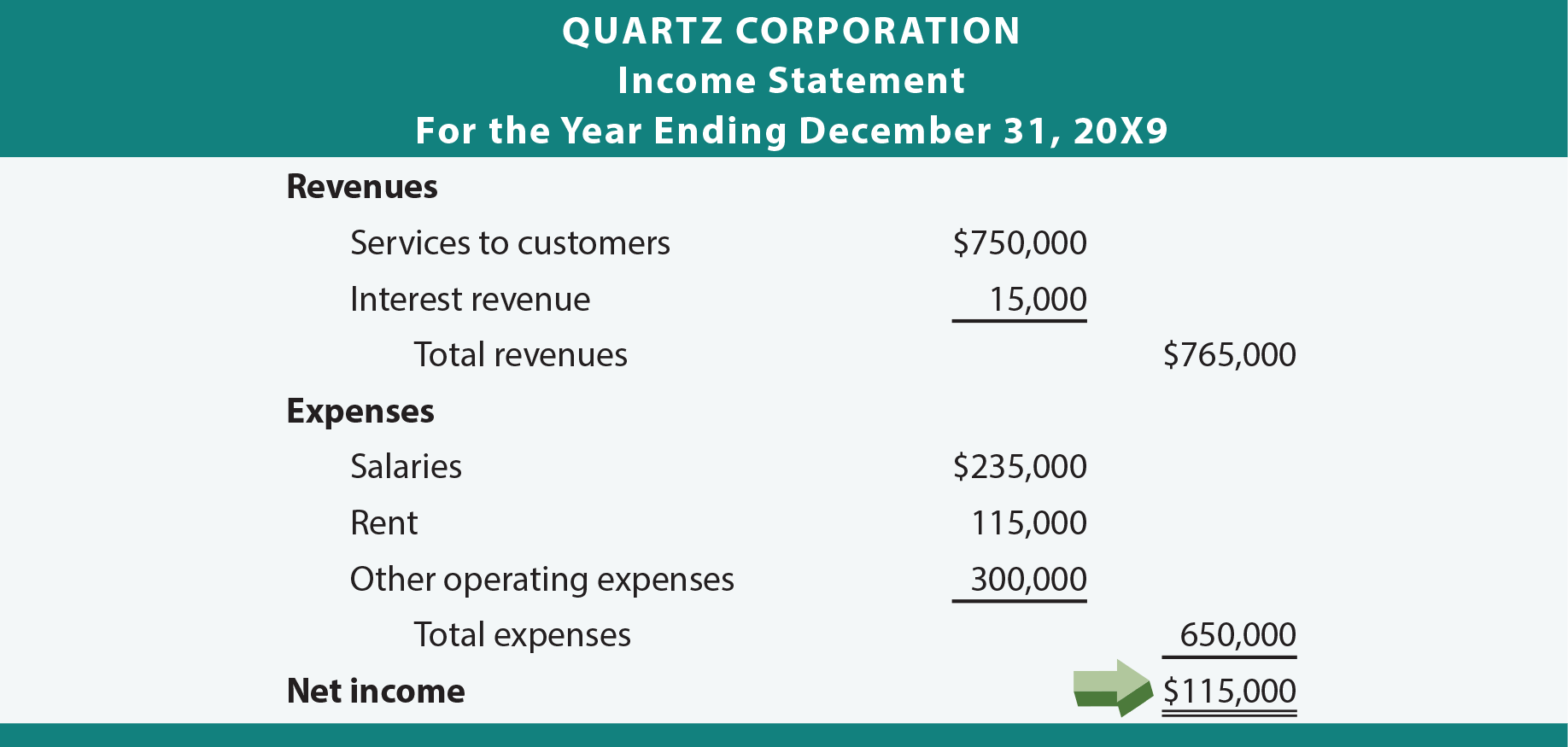

The Four Core Financial Statements Principlesofaccounting Com

It creates a negative drawings impact on the business.

. Owners equity is the amount that belongs to the owners of the business as shown on the capital side of the balance sheet and the examples include common stock and preferred stock retained earnings. It can decrease if the owner takes money out of the business by taking a draw for example. An owner of a C corporation may not.

Say for example that Patty has accumulated a 120000 owner equity balance in Riverside Catering. 0 20000 10000 10000 in retained earnings. Retained earnings can be used to pay additional dividends finance business growth invest in a new product line or even pay back a loan.

If a company has a healthy net income and retained earnings this may be a good time for them to reinvest some of their money into growing the business. Learn what retained earnings are how to calculate them and how to record it. Dividends and distributions are handled differently for tax purposes and shareholder capital.

The one that does NOT have a Register view no matter what it is named is Retained Earnings or Owner Equity that QB sill close the prior year into. An owners draw also called a draw is when a business owner takes funds out of their business for personal use. An owner of a sole proprietorship partnership LLC or S corporation may take an owners draw.

Owners equity can increment or decrease in four different ways. Owners draws are usually taken from your owners equity account. View solution in original post.

The Draw Account or Owners Draw is a Contra-Equity Account that should carry a Debit balance not negative. The business would record such overcompensations as directors or owners loans. The owners loan will be adjusted against dividends or distributions when available.

All business types sole ownerships organizations and companies utilize owners equity however just sole ownerships name the asset report account owners equity Partners utilize the expression accomplices equity and enterprises use Retained Earnings. You can adjust it based on your cash flow personal needs or how your company is performing. Owners draws can give S corps and C corps extra tax savings.

I think you need to sit down with a tax accountant and verify or get things correct. The WHY you took funds draw. The accounts you are referring to are cumulative in Wave.

Business owners might use a draw for compensation versus paying themselves a salary. The capital account is similar to the retained earnings account in a corporation. Answer 1 of 8.

If they then pay out 10000 in dividends to shareholders the retained earnings calculation would be. However that isnt without its risks. With the draw method you can draw money from your business earning earnings as you see fit.

If you net the accounts together you should get partner capital. Accumulated profits general reserves and other reserves etc. Owners Draws 50000 Total Closing Owners Equity.

Owners equity is made up of different funds including money youve. There are two main ways to pay yourself. Owners Equity Vs Retained Earnings And Business Taxes.

Owners Contributions is the account similar to common stock used to represent a direct investment by the owner not accumulated earnings. Retained earnings can also be accumulated losses of the business if the business has. Retained earnings is what is used to pay dividends and distributions the remainder stays in the corp.

Salary method vs. Retained earnings are profits or earnings of the business that have been kept for business use and not distributed to the owners or stockholders. Closing Drawing Account This is accomplished by making a credit entry in the drawing account for whatever the debit balance is and making a debit entry for that amount in the owners capital account.

If the owners draw is too large the business may not have sufficient capital to operate going forward. In other words retained earnings are accumulated earnings of a business after paying dividends or drawings to its stockholders or owners. An owners draw gives you more flexibility than a salary because you can pay yourself practically whenever youd like.

Then at the end of each year you should make a journal entry to credit the drawing account then debit owners equity. Rather than having a regular recurring income this allows you to have greater flexibility and adjust how much money you get depending on how. Retained earnings is where profits and losses get closed to at the end of the year.

So if I understand correctly your contributiondrawing is negative. You would do this by Journal Entry Debit - Owners Capital Acct because draws reduce capital Credit - Draw Acct this will zero out the debit balance. The Draw acct should be zeroed out to Owners Capital Sole Pro or Retained Earnings Corp at the end of each accounting period - a calendar or fiscal year - which ever one your business uses.

If you are generating profits which I assume you are in order to continue taking draws then your retained earnings would be positive. Recording owners draws To record owners draws go to your balance sheets Owners Equity Account and debit your Owners Draw Account while crediting your Cash Account. The information contained in this article is not tax or legal.

Owners draw is a temporary account which states the accumulated amounts an owner has withdrawn from the company presumably profits during a. In fact an owner can take a draw of all contributions and earnings from prior years. Often directors and owners draw more funds than accumulated retained earnings hence the equity.

The IRS tax implications are huge if youre an S corp or a C corp. The draw method and the salary method. An owners draw is an amount of money an owner takes out of a business usually by writing a check.

As for Owner Equity open the chart of accounts and try to open each Equity account. Retained earnings is the amount of net profit or loss a company has accumulated since its inception. How do you close out owners draw to retained earnings.

The removal of cash transaction is a debit to the temporary drawing account and a credit to cash. You cannot set up Subaccounts here.

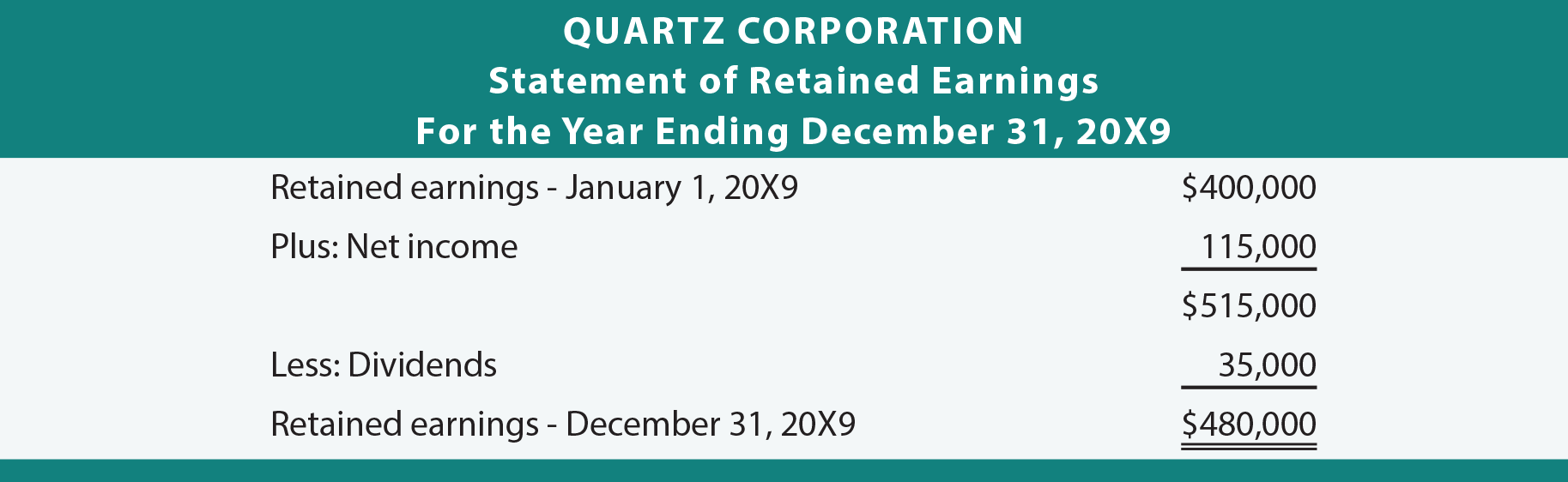

Statement Of Retained Earnings Definition Formula Example Video Lesson Transcript Study Com

The Four Core Financial Statements Principlesofaccounting Com

Understanding Retained Earnings In Quickbooks Youtube

/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

Expanded Accounting Equation Definition

Accumulated Other Comprehensive Income And Treasury Stock Accountingcoach

Retained Earnings Account Is Missing

Retained Earnings What Are They And How Do You Calculate Them

/EAE-e75afd7778c6484da673c69f0fdfbb55.png)

Expanded Accounting Equation Definition

Accounting Equation Retained Earnings Net Income Dividends Video Youtube

Retained Earnings Formula And Excel Calculator

Retained Earnings Formula And Excel Calculator

Retained Earnings What Are They And How Do You Calculate Them

A Retained Earnings Statement Is Used By Accountants To Also Keep Track Of A Tax Payer S Accounts Sales Report Template Statement Template Report Template

Retained Earnings Account Is Missing

Owners Equity Net Worth And Balance Sheet Book Value Explained

Retained Earnings Formula And Excel Calculator

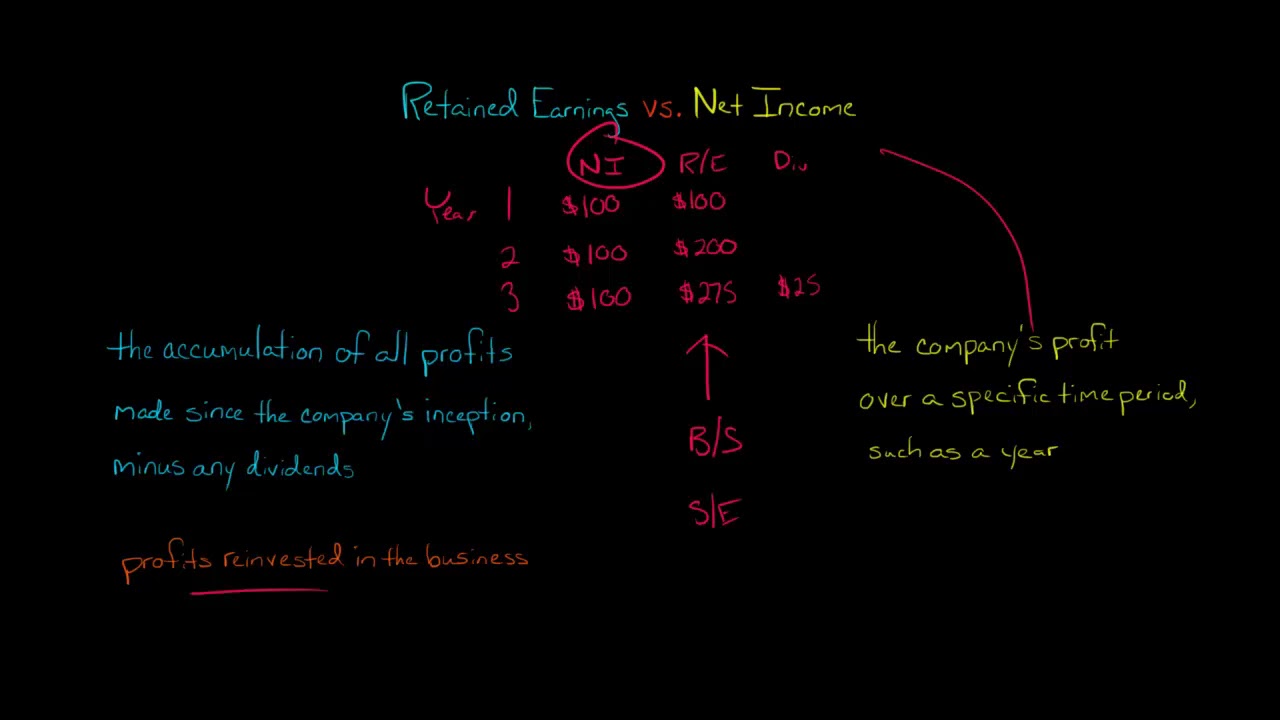

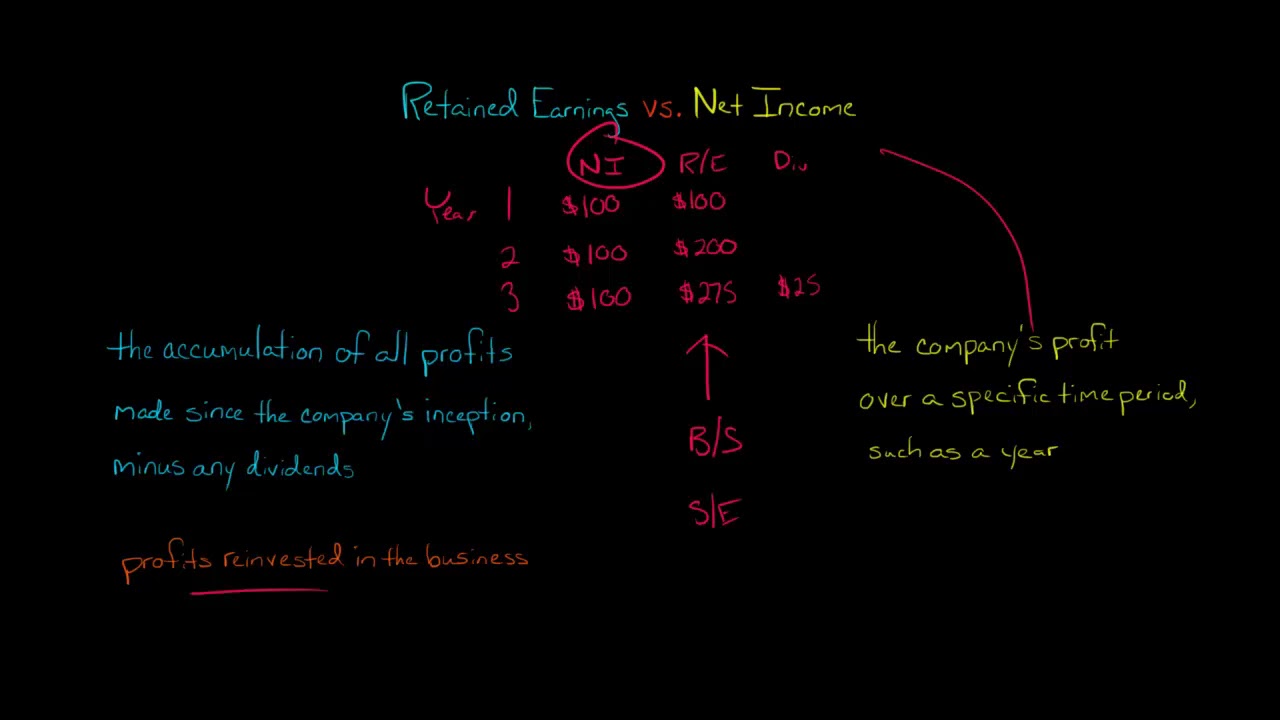

Retained Earnings Vs Net Income Youtube

How To Calculate Retained Earnings Formula Example And More

Retained Earnings What Are They And How Do You Calculate Them